At 31 December (CHF in millions) | 2018 | 2017 | Variance | in % |

Assets | ||||

Cash and cash equivalents | 499 | 418 | 81 | 19 |

Net financing receivables | 4,807 | 4,562 | 245 | 5 |

Personal loans | 1,885 | 1,782 | 103 | 6 |

Auto leases and loans | 1,974 | 1,942 | 32 | 2 |

Credit cards | 940 | 833 | 107 | 13 |

Other | 8 | 5 | 3 | 67 |

Financial investments | 11 | 12 | – 1 | – 9 |

Other assets | 124 | 108 | 16 | 15 |

Total assets | 5,440 | 5,099 | 341 | 7 |

Liabilities and equity | ||||

Deposits and debt | 4,325 | 4,048 | 277 | 7 |

Deposits | 2,827 | 2,627 | 200 | 8 |

Debt | 1,498 | 1,421 | 77 | 5 |

Other liabilities | 182 | 166 | 16 | 10 |

Total liabilities | 4,507 | 4,214 | 293 | 7 |

Shareholders’ equity | 933 | 885 | 48 | 5 |

Total liabilities and shareholders’ equity | 5,440 | 5,099 | 341 | 7 |

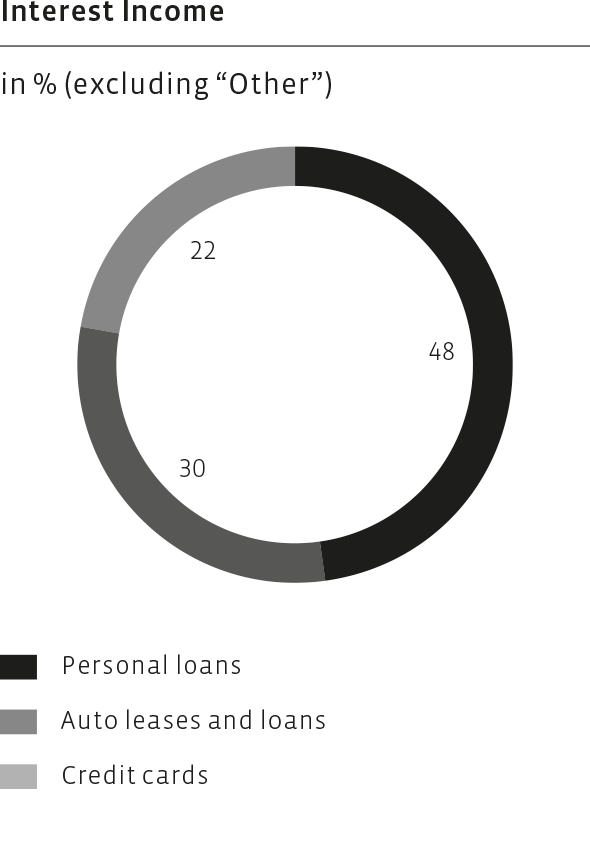

Net financing receivables amounted to CHF 4,807 million, an increase of 5% or CHF 245 million, compared to year-end 2017. At the end of 2018, the Group’s personal loans accounted for 39% (2017: 39%), auto leases and loans made up for 41% (2017: 43%), and the credit cards business accounted for 20% (2017: 18%) of the net financing receivables.

As of 31 December 2018, net financing receivables from personal loans were 6% higher at CHF 1,885 million compared to year-end 2017. Auto leases and loans grew by 2% to CHF 1,974 million compared to CHF 1,942 million at the end of 2017. Credit cards increased by 13% from CHF 833 million to CHF 940 million in the reporting period. Other net financing receivables of CHF 8 million (FY 2017: CHF 5 million) included the Swissbilling business which was acquired in February 2017.

Funding

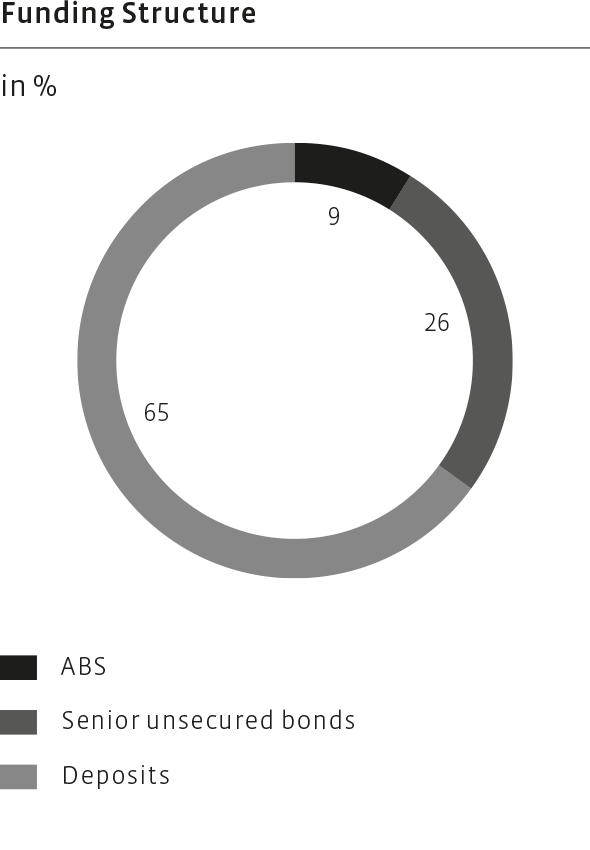

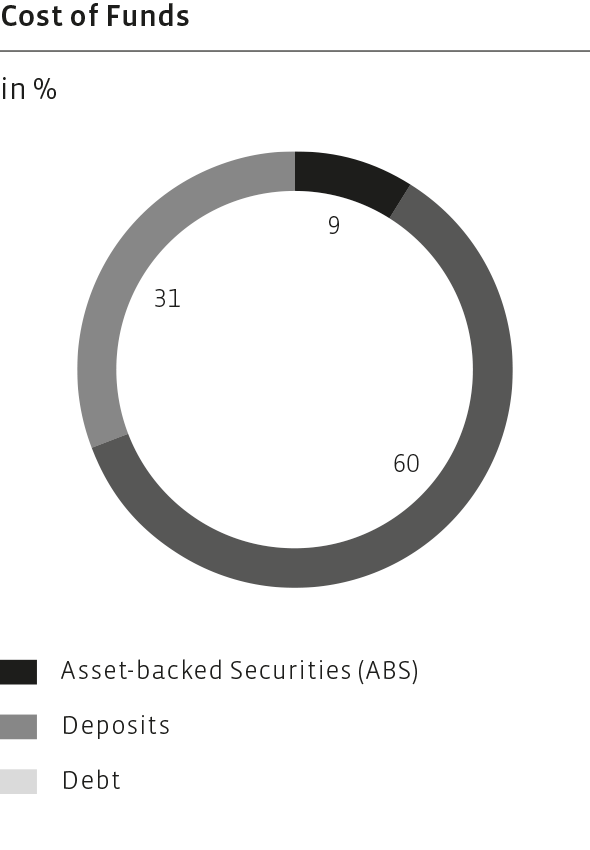

The Group maintained its funding diversification throughout 2018. The deposit base increased by 8% from CHF 2,627 million at 31 December 2017 to CHF 2,827 million at 31 December 2018. The institutional deposit base was 10% higher at CHF 1,868 million while retail deposits grew by 4% to CHF 959 million. The Group’s non-deposit debt increased by 5% from CHF 1,421 million as at 31 December 2017 to CHF 1,498 million as at 31 December 2018, mainly due to the issuance of two senior unsecured bonds. In February 2018, the Group raised CHF 50 million through a Floating Rate Note Private Placement with a two-year maturity (2018–2020). In May 2018, an additional unsecured bond of CHF 125 million with a maturity of 8 years (2018–2026) was placed in the market.

Equity

Total shareholders’ equity increased by CHF 48 million from CHF 885 million to CHF 933 million at year-end 2018. The increase was mainly driven by the net income of CHF 154.1 million and was partially offset by the dividend payment for the business year 2017 of CHF 100.1 million in April 2018.

Capital Position

At 31 December (CHF in millions) | 2018 | 2017 | Variance | in % |

Risk-weighted assets | 4,346 | 4,114 | 232 | 6 |

Tier 1 capital | 834 | 790 | 44 | 6 |

Tier 1 ratio (in %) | 19.2% | 19.2% |

Risk-weighted assets increased by 6% to CHF 4,346 million as per 31 December 2018 compared to CHF 4,114 million as per 31 December 2017. This increase was largely in line with the development of net financing receivables. The Tier 1 capital increased by CHF 44 million, or 6%, to CHF 834 million mainly as a result of the statutory net income generated in 2018 adjusted for the expected future dividend payment. This resulted in a Tier 1 capital ratio of 19.2% as per 31 December 2018 which was significantly above the regulatory requirement of 11.2% and the Group’s minimum target of 18.0%.