- Cembra

- Reporting

- Corporate Governance

- Compensation Report

- Financial Statements

Robert Oudmayer: Our Bank had another successful year in a competitive market environment. Our net income of CHF 144.5 million is slightly above the level of 2016. We were able to compensate the negative impact from the interest rate cap introduced in 2016. Our return on equity is very strong with 16.7%, and we maintained our cost discipline by keeping our operating expenses flat. All our business lines have reported growth this year. In the credit cards business we even recorded double-digit organic growth, again strongly outperforming the market. A big thank you goes to our more than 800 dedicated employees who made this strong result possible.

Dr Felix Weber (left) and Robert Oudmayer with Christa Rigozzi

Felix Weber: Indeed, we made use of our strong capital position and invested in growth, in line with our strategy. We acquired Swissbilling, which allowed us to enter the invoice financing business, a new business area for us. Furthermore, we acquired EFL Autoleasing with CHF 278 million net financing receivables to strengthen our position as the leading independent auto lease and loan provider in Switzerland. And we refinanced a CHF 42 million personal loan portfolio from eny Finance, a Swiss online personal loan provider.

Robert Oudmayer: We also signed a number of exciting new partnerships: We are now the preferred partner of a manufacturer of electric vehicles and the finance partner for Harley-Davidson motorcycles in Switzerland. In spring, we will launch a new credit card with the furniture store Interio, a subsidiary of our long-time partner Migros.

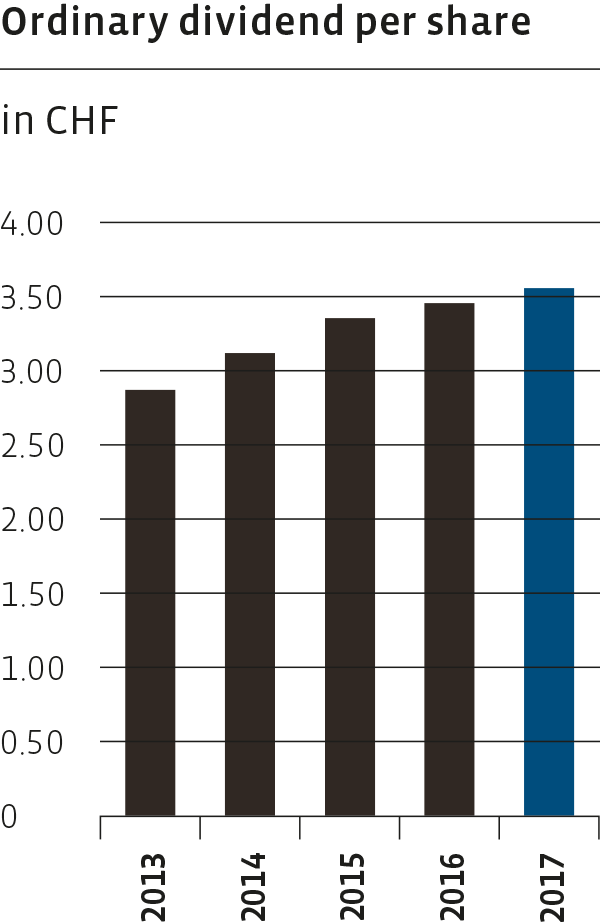

Robert Oudmayer: We have been independent for more than four years now. The business has always been highly profitable, and since our IPO we have an excellent track record. We have again achieved very good returns for our shareholders. We propose to the Annual General Meeting the payout of an attractive dividend of CHF 3.55 per share. The development of Cembra is predictable and stable. I am proud that the brand is now well established on the market. This is also thanks to you, Christa. You are a valuable Brand Ambassador for Cembra!

Felix Weber: Cembra has a long tradition and rich experience in consumer finance. We offer excellent customer service and have highly engaged employees who live the values of our Bank day by day. Strong values, stability, long-term thinking, and the fact that we always deliver on what we promise makes Cembra trustworthy and unique.

Felix Weber: Our share price performance and an attractive dividend make Cembra appealing for investors. For foreign investors, we have the advantage of being a pure Swiss business, operating in a country with economic and political stability. We have no foreign currency exposure, and we have a low loss rate. I believe the biggest sign of trust in Cembra is the fact that our number of customers is constantly growing. We now have more than 800,000 customers. The same is true for our shareholders; their number is currently at around 10,000, many of them Swiss retail investors. We have increased our ordinary dividend every year since the IPO and are committed to paying a solid dividend to our shareholders also in the future.

Robert Oudmayer: Our Bank has been on the Swiss market for more than 100 years, despite different owners and changing economic environments. This makes us a solid partner for our customers and an attractive employer.

Robert Oudmayer: Our employees are the key to Cembra’s success. They embody and share our values – engagement, customer focus, responsibility and diversity – and drive the Bank’s future. We need engaged employees, this is why we offer an inspiring and collaborative workplace, and flexible working solutions. We foster diversity, and we support our employees in their development.

Felix Weber: We will continue to mitigate the impact from the lower maximum interest rates. The reduction from 15% to 10% on consumer loans and from 15% to 12% on credit cards has moved the market players closer together and increased competition. The continuous development in the regulatory environment is keeping us on our toes and makes continuous investments a necessity. Of course, we also follow the development of new payment technologies. Since November 2017, Cembra supports mobile payment with smartwatches Garmin PayTM and FitBit Pay. In February 2018, we introduced Samsung Pay as mobile payment solution for four of our credit card programmes. We will also continue to invest in the digitalisation of

the business.

Felix Weber: The Bank pursues a clear strategy, which is based on three pillars. First, we want to defend our core business. We do this by acquiring new customers while retaining a competitive cost / income ratio. Secondly, we build the future by investing in digitisation and transforming the Bank from a product oriented to a customer centric organisation. And thirdly, we continue to invest in the long-term sustainable growth of the Bank. We want to gain size through further acquisitions, partnerships and joint ventures. Here, our focus is on consumer finance areas, primarily in Switzerland.

Our strategy

Defend the core business

Build the future

Gain size through acquisitions & diversification

has been Chief Executive Officer of the Bank since 2009. Before that he was CEO of GE Money Portugal and P&L Leader Auto & Retail of GE Money Bank Switzerland.

has been Chairman of the Board of Directors of Cembra Money Bank since 2013. He is partner in the private investment firm BLR & Partners since 2014. Before, Felix Weber held different management positions at Nomura Bank, Lehman Brothers Finance, Adecco and was partner at McKinsey & Company.

former Miss Switzerland and successful presenter and entertainer, has been Cembra’s Brand Ambassador since 2015.