At 31 December (CHF in millions) | 2017 | 2016 | Variance | in % |

Assets | ||||

Cash and cash equivalents | 418 | 669 | – 251 | – 38 |

Net financing receivables | 4,562 | 4,073 | 489 | 12 |

Personal loans | 1,782 | 1,720 | 62 | 4 |

Auto leases and loans | 1,942 | 1,641 | 301 | 18 |

Credit cards | 833 | 711 | 122 | 17 |

Other | 5 | – | 5 | – |

Financial investments | 12 | 12 | – | – |

Other assets | 108 | 104 | 4 | 4 |

Total assets | 5,099 | 4,857 | 242 | 5 |

Liabilities and equity | ||||

Deposits and debt | 4,048 | 3,874 | 174 | 4 |

Deposits | 2,627 | 2,355 | 272 | 12 |

Debt | 1,421 | 1,520 | – 99 | – 7 |

Other liabilities | 166 | 135 | 31 | 23 |

Total liabilities | 4,214 | 4,009 | 205 | 5 |

Shareholders' equity | 885 | 848 | 37 | 4 |

Total liabilities and shareholders' equity | 5,099 | 4,857 | 242 | 5 |

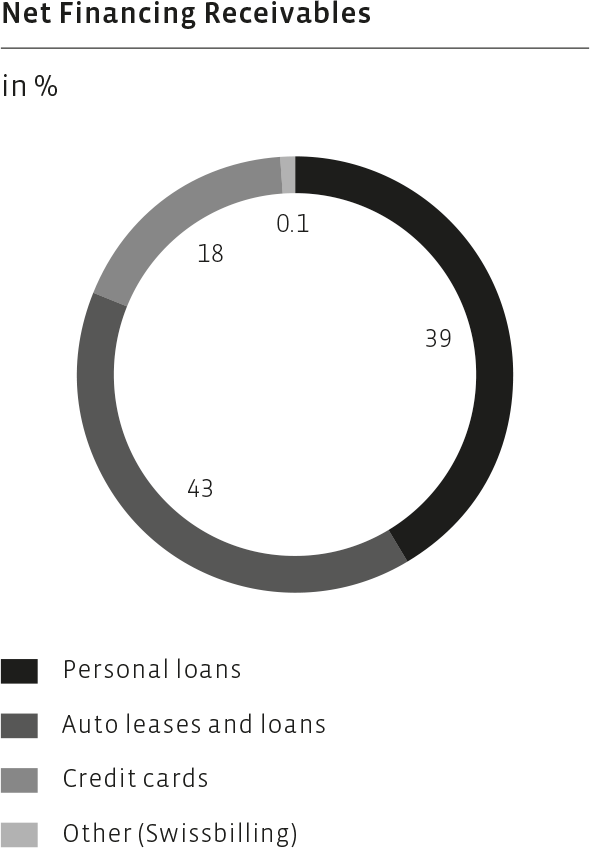

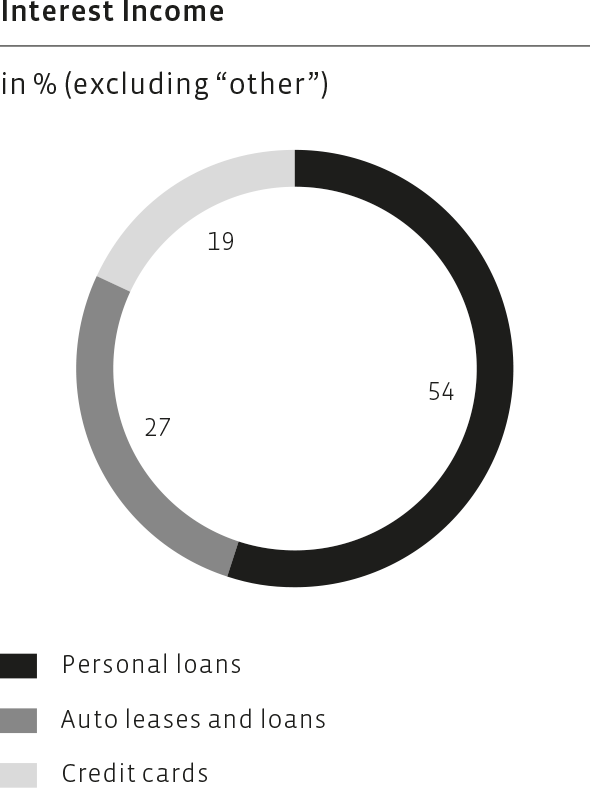

Net Financing Receivables

Net financing receivables amounted to CHF 4,562 million as at 31 December 2017, which was an increase of CHF 489 million or 12% compared to CHF 4,073 million as at 31 December 2016. Acquisitions and refinancing transactions contributed CHF 327 million to the increase while organic growth contributed CHF 162 million. At the end of 2017, the Group’s personal loans accounted for 39% (2016: 42%), auto leases and loans made up for 43% (2016: 40%), and the credit cards business accounted for 18% (2016: 18%) of the net financing receivables.

Receivables from personal loans increased by 4% to CHF 1,782 million including receivables from the refinancing transaction (CHF 44 million) with eny Finance. Auto leases and loans receivables grew by 18% to CHF 1,942 million at 31 December 2017 compared to CHF 1,641 million at year-end 2016, mainly driven by the acquisition of EFL Autoleasing (CHF 278 million). In 2017, credit cards receivables increased by 17% from CHF 711 million at year-end 2016 to CHF 833 million at year-end 2017. Other net financing receivables of CHF 5 million included the Swissbilling business which was acquired in February 2017.

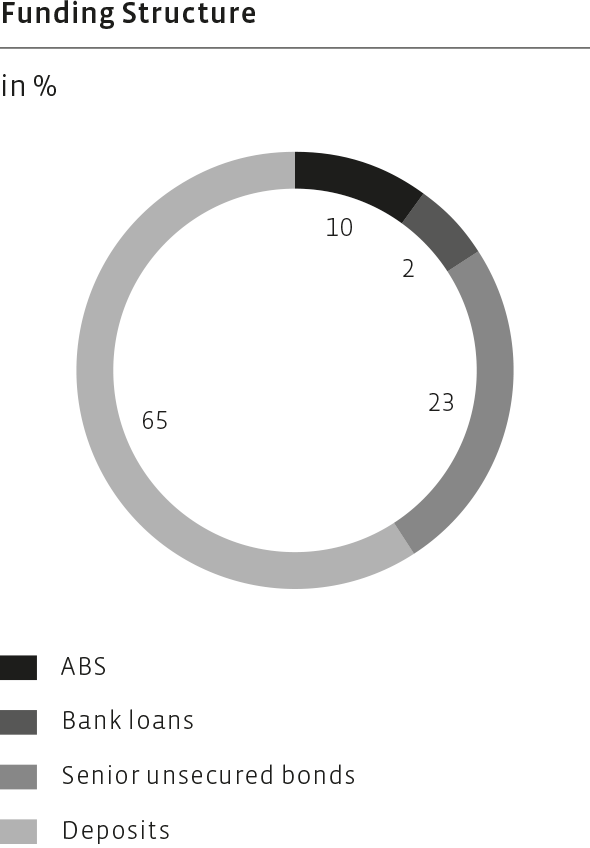

Funding

The Group maintained its funding diversification throughout 2017. Deposits grew by 12% from CHF 2,355 million as at 31 December 2016 to CHF 2,627 million as at 31 December 2017 in line with the higher receivable base. While the institutional deposit base was 20% higher at CHF 1,705 million, retail deposits slightly declined by 2% to CHF 922 million. The Group’s debt (excluding deposits) decreased by 7% from CHF 1,520 million as at 31 December 2016 to CHF 1,421 million as at 31 December 2017. This was primarily driven by a CHF 200 million reduction of bank loans and the maturity of a CHF 250 million senior unsecured bond partially offset by the issuance of two senior unsecured bonds. The Group returned to the capital markets in June 2017 and raised CHF 150 million through an unsecured bond with an eight year maturity (2017–2025). In October 2017, an additional unsecured bond of CHF 200 million with a maturity of 6.5 years (2017–2024) was placed in the market. Overall, the focus was on extending the overall maturity profile of the book and limiting future maturity concentration whilst further optimising the funding costs.

Shareholders' Equity

Total shareholders’ equity increased by CHF 37 million from CHF 848 million at year-end 2016 to CHF 885 million at 31 December 2017. The increase was mainly driven by the current year net income of CHF 144.5 million and was partially offset by the dividend payment for the business year 2016 of CHF 125.5 million in April 2017.

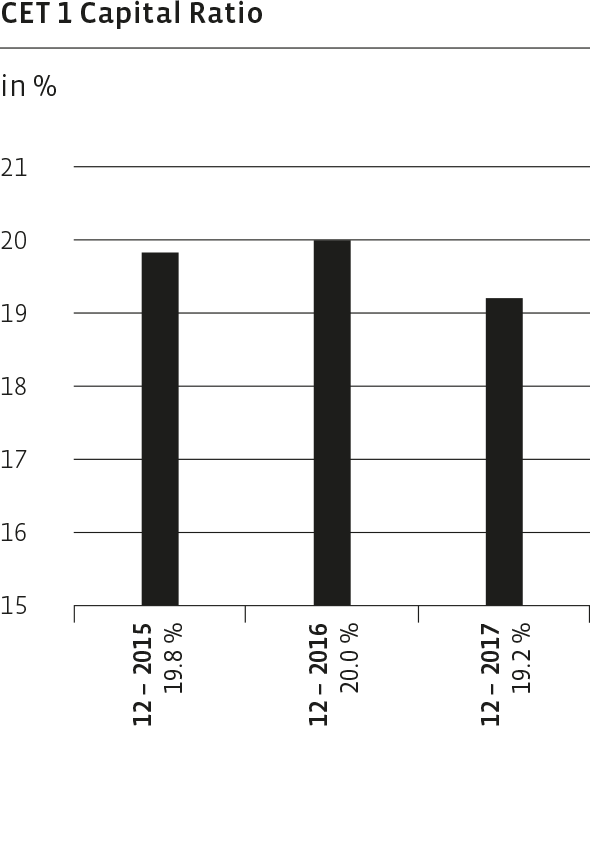

Capital Position

At 31 December (CHF in millions) | 2017 | 2016 | Variance | in % |

Risk-weighted assets | 4,114 | 3,758 | 356 | 9 |

Tier 1 capital | 790 | 753 | 37 | 5 |

Tier 1 ratio (in %) | 19.2% | 20.0% |

Risk-weighted assets increased by 9% to CHF 4,114 million as per 31 December 2017 compared to CHF 3,758 million as per 31 December 2016. This increase was in line with the development of net financing receivables. The Tier 1 capital increased by CHF 37 million, or 5 %, to CHF 790 million mainly as a result of the net income generated in 2017 adjusted for expected future ordinary dividend payments. This resulted in a Tier 1 ratio of 19.2% as per 31 December 2017 which was significantly above the regulatory requirement of 11.2% and the Group’s minimum target of 18.0%.